In the UAE, estate planning has become a major international confidence in terms of legal reforms particularly regarding family responsibilities, bank assets and property and business interest.

In terms of developing personal status laws, statutory clarity and new Wills framework majorly focused on non-Muslim residence, acknowledging Wills in Dubai has become a fundamental factor that can protect their loved ones and legacy.

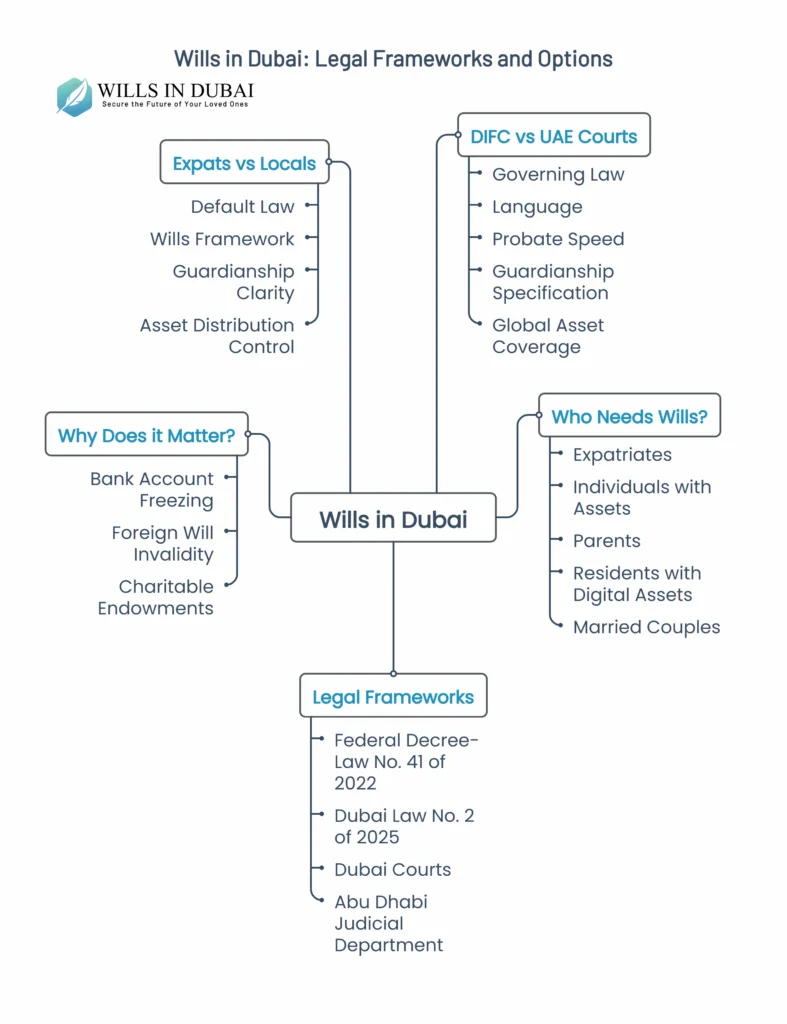

Wills in Dubai is a legal instrument that allows individuals to clarify their assets comprising business interest, digital assets, guardianship arrangements and bank and property funds. These assets under Wills in Dubai need to be distributed after death.

In absence of a registered Will, succession needs to be governed automatically with UAE inheritance rules which by default carried under sharia principles that often unpredictably apply to non-muslim estates.

With introduction of specialized wills systems along with civil law reforms has led to multiple jurisdictional options for restructuring succession planning that further leads to active legal tools instead of a passive contingency.

Learn about Wills for Non-Muslims.

Anyone investing or residing in the UAE with dependents and assets should strongly consider wills. This comprises:

Why does it matter?

In the UAE,

These realities make estate planning as financial and legal imperative.

The legal treatment of Wills in Dubai differs in terms of religion, nationality and the legal framework. Here is what you need to learn about the differences.

| Category | Non-Muslim expatriates | Muslim expatriates | UAE nationals |

| Default law | Civil distribution laws | Sharia law unless superseded. | Sharia law. |

| Wills’ framework available | UAE courts, Abu Dhabi courts, DIFC wills | UAE courts. | UAE courts (sharia) |

| Guardianship clarity | Can expressly appoint through will. | Sharia+court. | Sharia+court. |

| Asset distribution control | High (if will registered) | Limited without civil alternatives | Sharia shares depend. |

Note: Recent legal reforms have broadened the options for non-Muslims.

UAE based estate planning is governed under several overlapping legal regimes.

Key laws & jurisdiction

Opting for the right jurisdiction depends on where you registered and enforced with practical and legal consequences. Here is a quick difference that we need to know.

| Feature | DIFC Wills | UAE Court Wills |

| Governing law | Common law style | UAE civil + possible Sharia application. |

| Language | English | Arabic. |

| Probate speed | Generally faster | Can be longer. |

| Guardianship specification | Clear, common-law support. | Court directed |

| Global asset coverage | Better suited for cross-border assets. | Depends on court interpretation. |

As Dubai’s financial ecosystem grows with DIFC Centre registration rising over 32% in H1 2025 — Wills and succession services are integral to private wealth frameworks.

Regarding Wills in Dubai, there are common mistakes that are required to be resolved before propagating into it. Here are the mistakes and its related consequences:

| Common mistakes | Resulting consequences |

| Relying on unregistered foreign wills. | UAE may disregard. |

| Guardianship clause missing. | Child custody under court decision. |

| Not updating Wills after life events. | Outdated asset distribution. |

| Assuming joint accounts bypass probate. | The bank account remains frozen. |

| Ignoring digital or business assets. | Legal gaps and succession disputes. |

Get more with us and exploreAbout Us!

Conclusion

Wills in Dubai are now a central piece of modern estate planning for residents and expatriates alike. With civil law reforms, DIFC expanding jurisdiction, increasing digital and global asset classes, establishing a properly registered will can lead to legal certainty, asset distribution and family protection. Now it’s your chance to get your Wills in Dubai with just one step

Let’s Connect with Us and get legal guidance.

Not mandatory but recommended to avoid default inheritance rules and asset uncertainty.

Smooth execution requires to be done under UAE or DIFC courts.

Assets in absence of heir will go to certified charities under legal process.

Yes, DIFC now supports digital asset Wills such as crypto holdings.

Registered DIFC draftsman or qualified UAE lawyer ensures legal validity and compliance.